RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef. An example for the calculation of stamp duty of shares is that for every RM 1000 or fractional part of RM 1000 will be imposed to RM 3.

Stamp Duty Legal Fees New Property Board

Stamp duty of 05 on the value of the services loans.

. The stamp duty is free if. The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

This also consists of legal fees stamp duty and legal disbursement fees. From RM500001 to RM1mio. For the first RM100000.

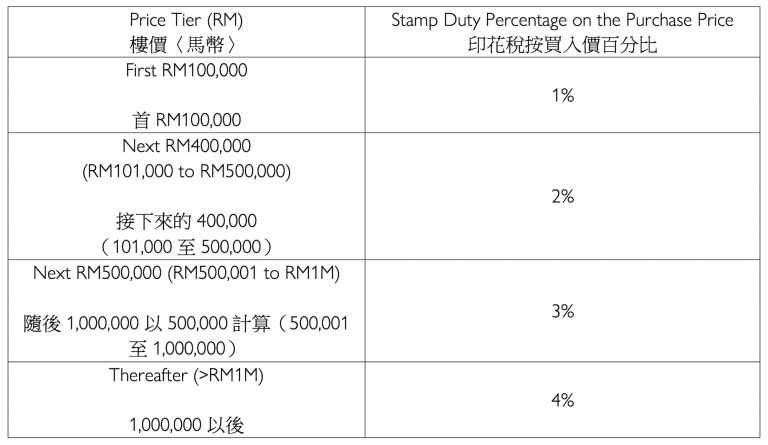

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. From RM100001 to RM500000. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later.

The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your stamp duty and may get stamping on your tenancy agreements done here we have included the LHDN stamping fee calculator. Below is our own calculator we have created for you to try out. The following are the items you need to find out the cost of and are dependent on your property price.

The Calculation is base upon Monthly Rental and period of Rental signed in the Tenancy Agreement. The 2020 Guidelines indicate that the stamp duty will be imposed on the value of shares rounded up to the nearest thousand. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400.

Feel free to use our calculators below. Stamp duty also applies for loan agreements but it is capped at a maximum rate of 05 of the full value of the loan. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

Transfer of ownership aka memorandum of transfer MOT. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Now that you know the Loan Agreement stamp duty rates in Malaysia let us do some calculations on the actual amount you will pay for.

STAMP DUTY CALCULATION. The Web App below will assist you to calculate Stamp Duty Payable Legal Fee Payable and estimated Admin Fee Payable. This means that for a property at a purchase price of RM300000 the stamp duty will be RM5000.

Property Selling Price Market Value whichever is higher. Sale Purchase Agreement SPA. The stamp duty for the SPA is only RM10 per copy while the stamp duty for MOT and DOA is calculated according to a fee structure of 1 to 4.

When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to the government. This consists of legal fees stamp duty and legal disbursement fees. Rental fees stamp duty and tenancy agreements can be confusing to anyone moving in or leasing.

Service Agreements and Loan Agreements. Shares or stock listed on Bursa Malaysia. The stamp duty in Malaysia is a tax based on different tiers as below.

Total Stamp Duty Payable by Purchaser. The stamp duty fee for the first RM100000 will be 1000001 RM1000 The stamp duty fee for the remaining amount will be 300000-1000012 RM4000. The stamp duty is free if the annual rental is below RM2400.

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Malaysia Stock Calculator Apps On Google Play

Mot Calculation 2020 Property Paris Star

Peps Malaysia Stamp Duty Calculation Follow Peps Malaysia Facebook Page To Get Experts Insights On Property In Malaysia Stampdutymalaysia Pepsmalaysia Propertytaxmalaysia Facebook

Malaysia Legal Fees Cal Apps On Google Play

Tenancy Agreement Stamp Duty Malaysia Financial Blogger Ideas For Financial Freedom

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

What Is A Trust Deed And Why Is It Important

Buying Property And Stamp Duty Planning Action Real Estate Valuers

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

A Checklist For The Malaysia Property Buying Process

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Best Free Home Loan Calculator Stamp Duty Legal Fees Included